Contents:

The main goal of measuring the contingent exposure of a firm is to determine the risk to your business by estimating the costs that will come with a currency fluctuation. The measurement of contingent exposure is based on the direct costs and expenses incurred when the prices change because of an exchange rate. There are a lot of consequences for economic exposure to an exchange rate, and this is one of the reasons why it is crucial to invest in currency protection for businesses to minimize the loss. For this reason, accountants will choose from various options that will convert foreign holdings close to your domestic currency. With this, they can choose whether to convert at the current exchange rate or at a historical rate.

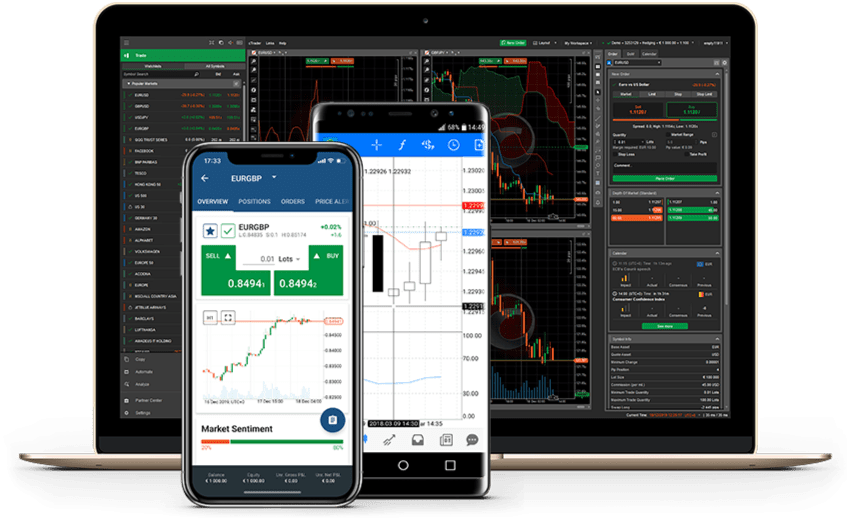

Currency risk refers to the potential for gains or losses resulting from the fluctuations between various currencies. Currency risk can affect everyone from multinational companies to governments, to tourists on an overseas vacation. Hedging strategies can help business people better control the daily currency fluctuations and enhance planning reliability of their companies.

How do you mitigate foreign exchange risk?

On the contrary, should the euro devalue against the dollar, the company will need a lesser amount in terms of US dollars. To manage this risk of paying more upon maturity date, you entered into a foreign currency forward contract with a third-party speculator. If you have, you may remember dealing with the exchange rate, which tells you how much your dollar is worth in euros, pesos, yen, or whatever the foreign currency is.

Perficient Reports Fourth Quarter and Full Year 2022 Results … – Perficient, Inc.

Perficient Reports Fourth Quarter and Full Year 2022 Results ….

Posted: Tue, 28 Feb 2023 13:06:02 GMT [source]

One simple, flexible, and liquid alternative to hedge against currency risk are currency-focused exchange-traded funds . Operating exposureto foreign exchange risk is the impact of exchange rate changes on a company’s future operating revenues and costs. Two popular and inexpensive methods companies can use to minimize potential losses is hedging with options and forward contracts. If a company decides to purchase an option, it is able to set a rate that is “at-worst” for the transaction.

Economic risk

It may be that a https://trading-market.org/ accepts the risk of currency movement as a cost of doing business and is prepared to deal with the potential earnings volatility. The company may have sufficiently high profit margins that provide a buffer against exchange rate volatility, or they have such a strong brand/competitive position that they are able to raise prices to offset adverse movements. Additionally, the company may be trading with a country whose currency has a peg to the USD, although the list of countries with a formal peg is small and not that significant in terms of volume of trade . From the holidaymaker planning a trip abroad and wondering when and how to obtain local currency to the multinational organization buying and selling in multiple countries, the impact of getting it wrong can be substantial. Due to the interconnectivity of the financial markets, a significant price change in one currency can impact several other currencies, or even other markets such as shares, indices or gold.

84% of retail investor accounts lose money when trading CFDs with this provider. Price risk, which is the uncertainty related to the future price of an asset. In the equipment example above, let’s assume the company wishes to take out an option instead of a forward contract and that the option premium is $5,000. The opposite effect can of course occur, which is why, when reporting financial performance, you will often hear companies quote both a “reported” and “local currency” number for some of the key metrics such as revenue. Following on from the above example, let’s assume that the US company decides to set up a subsidiary in Germany to manufacture equipment.

Example of Foreign Exchange Risks

Then it needs to do a proper calculation to analyze the exposure to the foreign exchange risk. First, it’s important to understand what’s happening with a particular country’s currency in relation to inflation levels and debt. If a country is carrying high levels of debt, for example, that can be a precursor to increasing inflation.

Companies can also request clients to pay in the company’s domestic currency, whereby the risk is transferred to the client. Investors and businesses exporting or importing goods and services, or making foreign investments, have an exchange-rate risk but can take steps to manage (i.e. reduce) the risk. There is always currency risk potentially involved in exchanging money. Currencies move all the time, so it presents both an opportunity and a potential loss to investors and any businesses conducting operations abroad or purchasing supplies from overseas. Currency hedging is when an individual or firm takes a financial position that reduces or eliminates its risk as it pertains to exchange rate fluctuations.

- The bank will typically charge a fee or spread for taking this long-term currency swap.

- Dollar appreciated sharply against rival currencies such as the Japanese Yen.

- Risk takes on many forms but is broadly categorized as the chance an outcome or investment’s actual return will differ from the expected outcome or return.

- Nowadays, currencies tend to have free-floating exchange rates set by market forces, though in some cases, countries still use foreign currency pegs where the price of one currency is closely tied to another.

- While holding this stock, the euro exchange rate falls from 1.5 to 1.3 euros per U.S. dollar.

These so-called smart beta funds provide the easiest option for investors assuming that a currency-hedged option is available for the index they want to invest in. Translation exposureto currency risk is the effect of exchange rate changes in the current balance sheet and income statement. When the corresponding foreign currency denominated accounts receivable/payable are issued and appear on the firm’s balance sheet, the transaction creates accounting exposure as well. Currency invoicing refers to the practice of invoicing transactions in the currency that benefits the firm. It is important to note that this does not necessarily eliminate foreign exchange risk, but rather moves its burden from one party to another.

Transaction hedging

Both integrated and self-sustaining foreign entities operate use functional currency, which is the currency of the primary economic environment in which the subsidiary operates and in which day-to-day operations are transacted. Management must evaluate the nature of its foreign subsidiaries to determine the appropriate functional currency for each. Transaction risk refers to the adverse effect that foreign exchange rate fluctuations can have on a completed transaction prior to settlement. Managing currency risk began to capture attention in the 1990s in response to the 1994 Latin American crisis when many countries in that region held foreign debt that exceeded their earning power and ability to repay. The 1997 Asian currency crisis, which started with the financial collapse of the Thai baht, kept the focus on exchange-rate risk in the years that followed. In this lesson, we looked at how to deal with exchange rate and how to engage in currency hedging to manage financial risk.

- It proves to be a prerequisite for analyzing the business’s strength, profitability, & scope for betterment.

- Forward and options contracts can help in protecting from foreign risk.

- If the receipt date were moved sooner, this would be termed leading the payment.

- You will make a loss on the trade, but it protects you from incurring more substantial losses caused by a sudden or drastic change in currency value.

Institutional https://forexaggregator.com/, such as hedge funds and mutual funds, as well as major multinational corporations, hedge currency risk in the forex market, and with derivatives like futures and options. An interest rate swap, which is a contract whereby two parties agree to exchange cash flows for future interest payments based on a contract of loan. A forward contract, which is an agreement between two parties to exchange a specified amount of commodity, security, or foreign currency on a specified date in the future at a specified price or exchange rate. An interest rate swap is a contract whereby two parties agree to exchange cash flows for future interest payments based on a contract of loan. A forward contract is an agreement between two parties to exchange a specified amount of commodity, security, or foreign currency on a specified date in the future at a specified price or exchange rate. As part of MM management, you know that when the dollar devalues against the euro, the company will have to pay more in dollars to settle the obligation.

Strategies other than financial hedging

It is surprising how many investors do not realize it, but when they invest in international stocks, currency fluctuations have a significant impact on their returns. The currency hedger buys or books different types of contracts that are designed to achieve specific goals, which are based on the level of risk he or she is exposed to. The individual can lock in future rates without undermining his or her liquidity significantly.

Currency hedging is the creation of a foreign currency position, simply known as a “hedge“, with the purpose of offsetting any gain or loss on the underlying transaction by an equal loss or gain on… The time span between the moment the sale is initiated and settled creates currency risk as for the EUR cash flow as the EUR-USD rate fluctuates. Investors will therefore not face any currency risk, because they will not have to invest in dollar denominated or rupee denominated contracts.

Biologics CDMO market size to increase by USD 13.26 billion from 2022 to 2027: Strong research and development pipeline of biologics therapeutics to boost market growth – Technavio – Yahoo Finance

Biologics CDMO market size to increase by USD 13.26 billion from 2022 to 2027: Strong research and development pipeline of biologics therapeutics to boost market growth – Technavio.

Posted: Thu, 02 Mar 2023 22:05:00 GMT [source]

In the scenario that the USD strengthens from €/$ 1.1 to 0.95, then the https://forexarena.net/ would let the option expire and bank the exchange gain of $15,000, leaving a net gain of $10,000 after accounting for the cost of the option. Even the tiny foreign exchange movement would result in huge losses if not managed properly. The period for which the business will hold the foreign currency or exchange position. While you can’t really predict the change that will happen as various currencies fluctuate, what you can do, however, is compute the gains and losses of the currency exchange. Not only that, but getting currency protection for your business is another great way to shield your company from these fluctuating currency changes.